Task Force on Climate-related Financial Disclosures ,TCFD

The World Economic Forum (WEF) released the Global Risks Report 2024 on January 10, 2024. The report indicated widespread concerns about the future. Environmental risks ranked high for 2024 and in both short-term and long-term risk perceptions. Social extremism and the development of artificial intelligence (AI) make obtaining the “truth” challenging, and geopolitical and economic divisions make global cooperative governance a difficult task. However, taking actions from various dimensions and working together to reduce global disaster risks remains the best solution.

The 29th Conference of the Parties (COP29) to the United Nations Framework Convention on Climate Change was held in November 2024 in Baku, the capital of Azerbaijan. Key resolutions included:

- New collective quantified goal (NCQG): Developed countries agreed to provide at least US$300 billion annually in climate finance by 2035 to support developing countries in addressing climate change and transitioning to low carbon economies. However, developing countries expressed dissatisfaction with the amount, considering it insufficient to meet actual needs.

- Carbon market mechanism: In accordance with Article 6 of the Paris Agreement, COP29 established the operating rules for the international carbon market, promoting greater transparency and standardization in global carbon trading and laying the foundation for the development of a unified global carbon market.

- Reducing methane emissions from organic waste: COP29 adopted a resolution to reduce methane emissions from organic waste, emphasizing the importance of reducing methane emissions in waste and food systems and urging countries to take action.

- Digital transformation and climate action: For the first time, the conference formally included digital transformation in its agenda, issuing the Declaration on Green Digital Action, which calls for reducing carbon emissions in the ICT sector and promoting the application of digital technologies in climate monitoring and energy optimization.

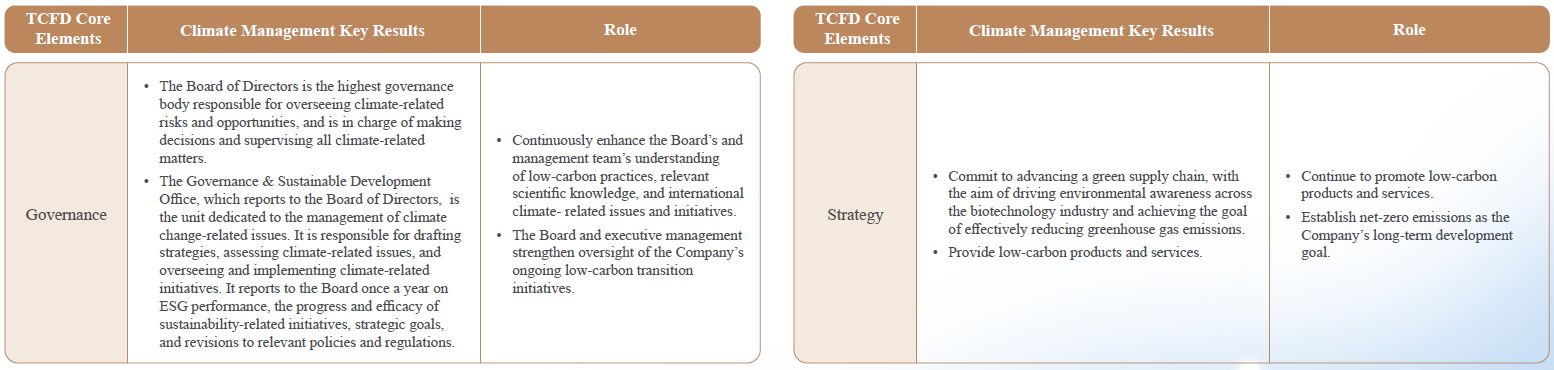

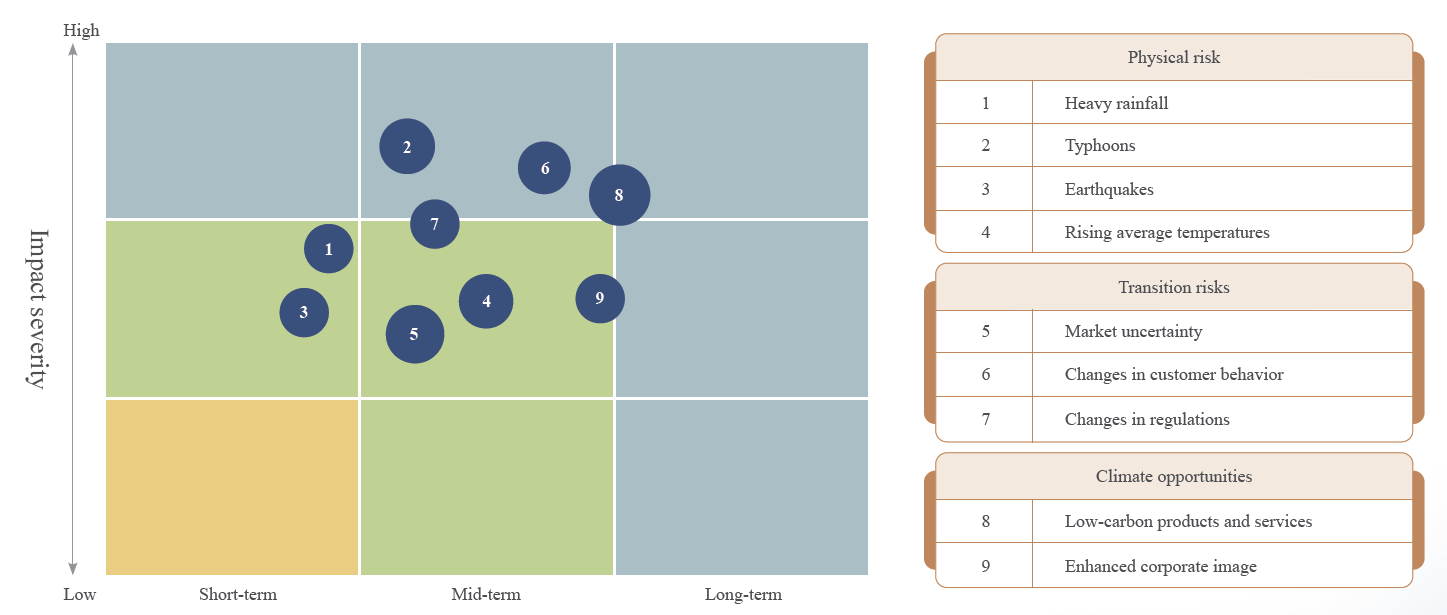

The implementation of ESG (Environmental, Social, and Governance) strategies to promote low-carbon operations has become a global development trend. UVB has recognized the significant impact of climate change on the economy, society, and the environment. As the leading company in the field of vision biotechnology in Taiwan, we take our corporate social responsibility seriously and actively respond to the challenges posed by climate change. To assess and analyze the impact of climate-related risks and to develop control measures, UVB has adopted the framework proposed by the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD). This framework includes disclosures on governance, strategy, risk management, and metrics and targets, providing investors and stakeholders with insight into UVB’s climate action.

01 GovernanceUVB stay highly attentive of our climate change risks and opportunities to ensure that we can fulfill our responsibilities to society, the environment, and all our stakeholders. All members of our management team from our chairman to senior managers consider climate change to be an important corporate issue and work to monitor and manage climate topics using an effective governance framework.

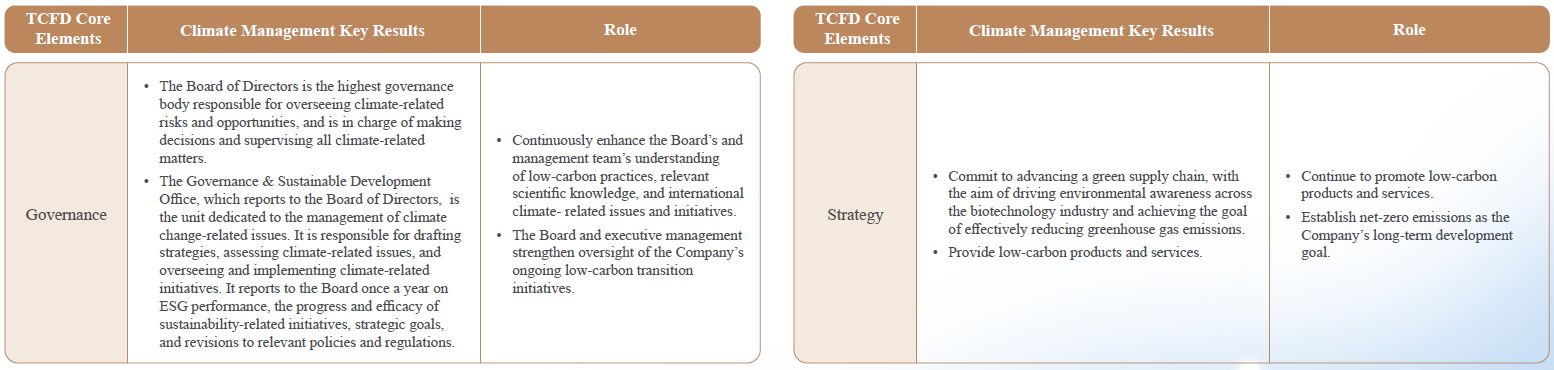

Board of Directors of UVB serve as the highest governing body to drive corporate sustainability. Guided by principles of ethical business conduct and the protection of shareholder interests, the board oversees a broad spectrum of environmental risks and opportunities, including those related to climate change impacts.

To advance corporate sustainability, the Board of Directors approved the Sustainable Development Best Practice Principles, established the Governance and Sustainability Office, and initiated various sustainability initiatives.

On August 13, 2025, the Board of Directors established the Sustainable Development Committee, and on November 12, 2025, the Board reported on the implementation status of climate risk management for the 2024 fiscal year.

02 Strategy

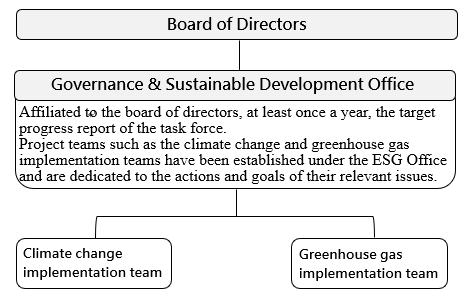

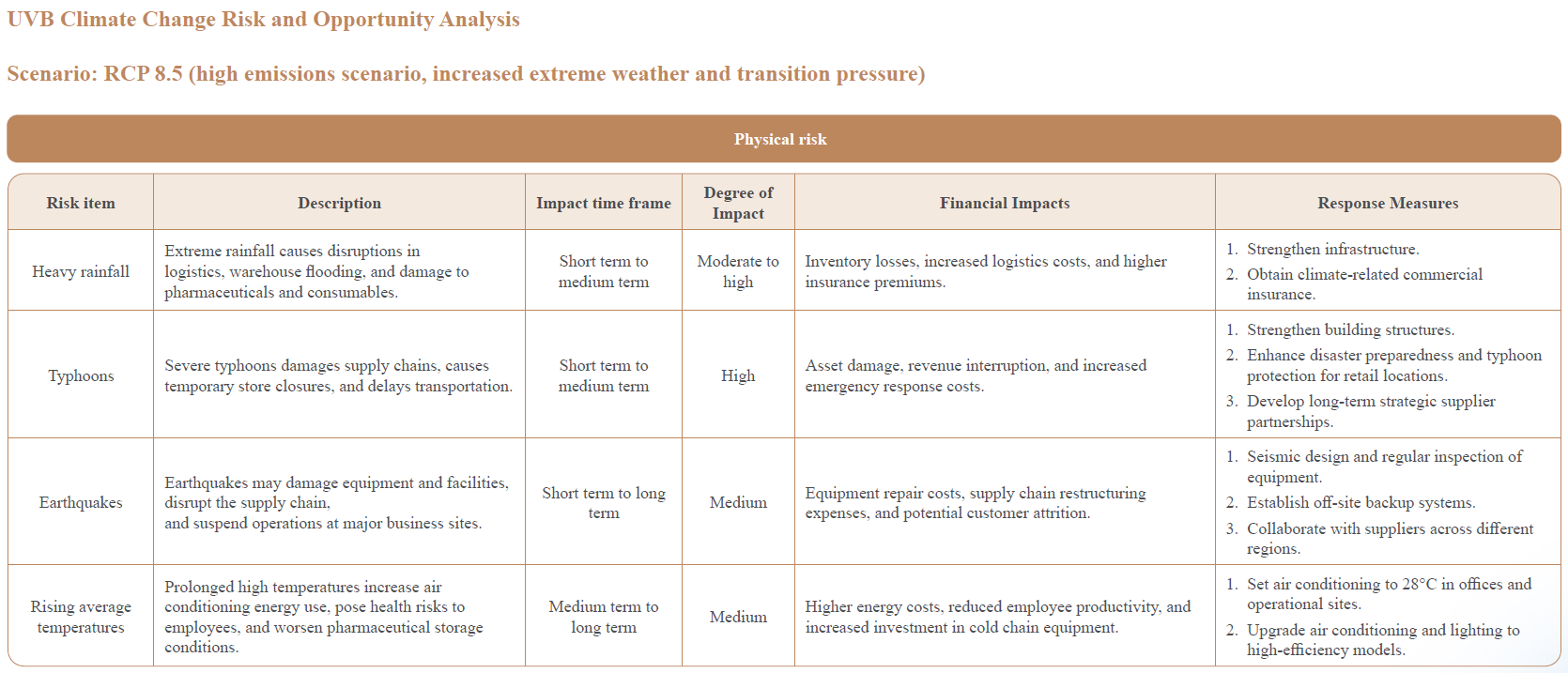

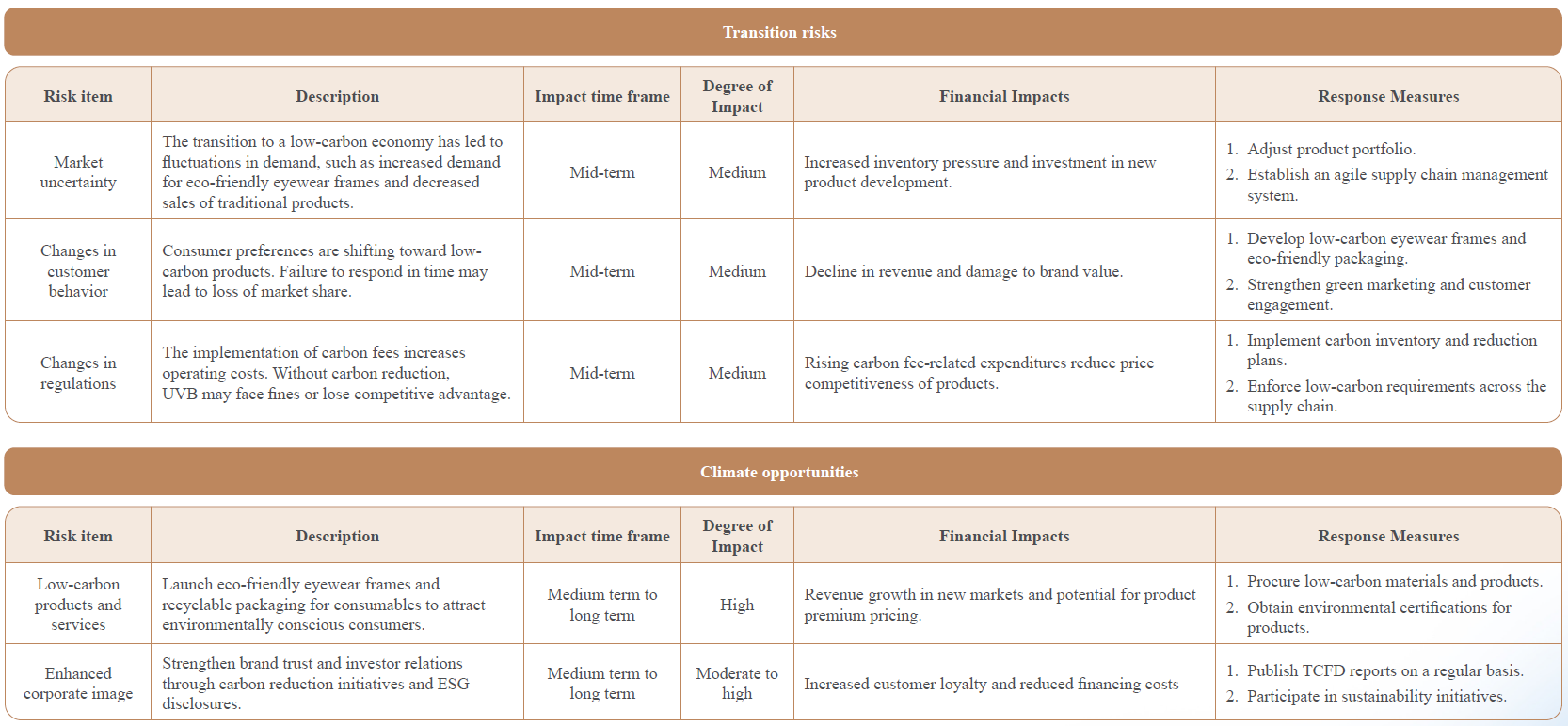

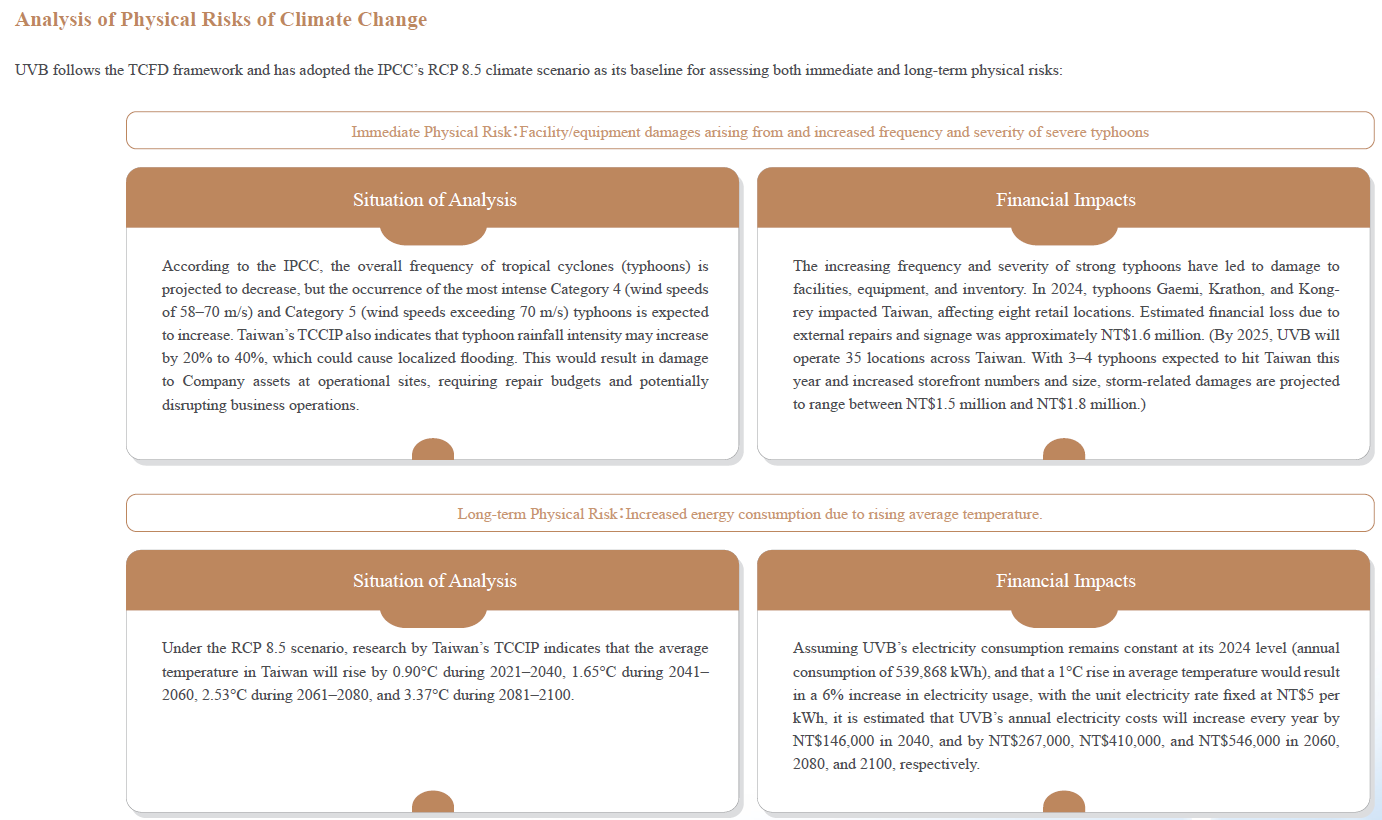

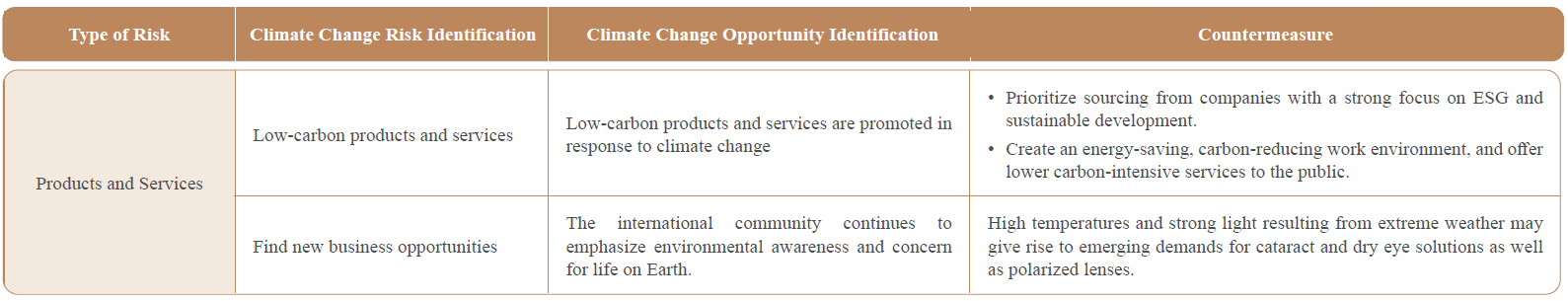

02 StrategyThe Governance & Sustainable Development Office evaluated the major climate-related risks and opportunities currently faced by UVB using the TCFD framework, and developed a TCFD materiality matrix. This matrix analyzes potential physical and transition risks, as well as related business opportunities, across short-, medium-, and long-term time frames. Based on this analysis, the Company has formulated mitigation and adaptation strategies to enhance its climate resilience. The results are as follows:

03 Risk Management

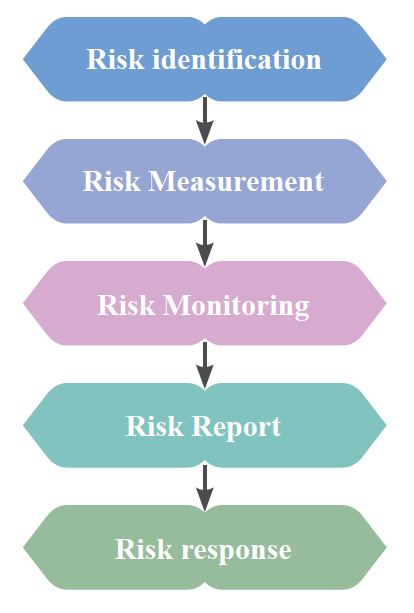

03 Risk ManagementIn order to enhance the Company’s corporate governance, establish an effective risk management mechanism, assess and supervise the risk-taking ability and the current risk management situation, UVB expected to approve the “Risk Management Policies and Procedures” in 2023 as the Company’s highest guiding principle of risk management. Trough the policies and procedures, the Company integrates and manages various potential strategic, operational, financial and hazardous (climate change, legal compliance, market competition) risks that may affect operations and profitability, carries out risk warnings and takes appropriate preventive measures, or maintains operational activities in the event of an accident.

The responsible unit identifies relevant risk factors, analyzes the potential impact of each risk on the Company’s operations, and develops and adopts measures to control risks within the Company’s tolerable range. The board of Directors receives regular reports from the Risk Management Task Force and supervises the status of risk management execution by the Company and its important subsidiaries. The risk management results of 2024 were reported to the Board of Directors on November 13, 2024.

04 Metrics and Targets

04 Metrics and TargetsAlthough energy consumption, water use, and waste management are not major issues of the company, we still use the results of greenhouse gas inventory to introduce circular economy thinking, reduce waste and strengthen climate and environmental issues to improve our colleagues. Recognize with cooperative units to reduce carbon emissions generated during operation. The Company conducts risk identification for climate change, including analysis of risks and opportunities caused by direct or indirect impacts due to extreme weather, transition impacts of regulations, technology, or market demand, and other humanistic and social aspects on the Company’s operating activities. A risk management strategy plan is established based on the analysis results to serve as the core of climate change response actions, and relevant opportunities are identified to reduce risks and to seize business opportunities.

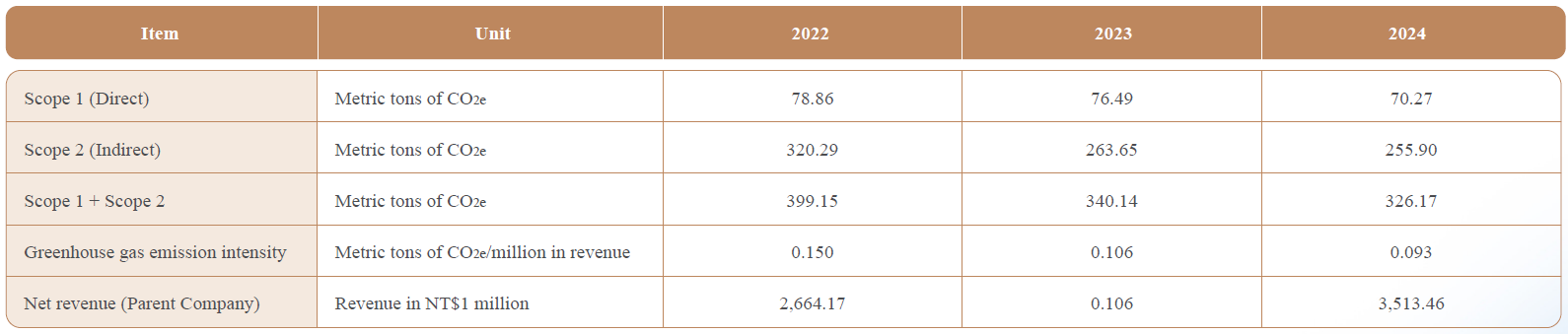

In order to implement sustainable measures, the Board of Directors approved the“ Sustainable Development Best Practice Principles” and established ESG Office to carry out various sustainability actions. In terms of climate action, we serve as a platform for horizontal collaboration and vertical integration, managing our greenhouse gas inventory and disclosures. The calculated total emissions are as follows:

Climate Management Results and Goals

Climate Management Results and Goals